So We Built a Proven Equity-Aligned Operating Model Instead.

Buy. Operate. Exit.

Two Asset Types. Your Choice.

We partner with you to acquire and operate two types of hospitality assets.

We are not a fund. Investors participate on a deal-by-deal basis through direct ownership or operating partnerships. We act as the operating partner, not a financial product issuer.

Luxury Vacation Rentals

For those wanting luxury vacation homes in high performing proven markets

Boutique Hotels

Direct operating partnerships in commercial-grade hospitality assets built for scale.

Our Results and History

Industry Leading Results

Real assets. Real revenue. Real results.

In combined bookings generated across operated assets, partner and

client portfolios combined.

In luxury homes, hotels and resorts properties listed over a ~10 years.

Views across TV, Social Media, news and

other digital platforms globally.

Qualified partnerships only.

Ownership Only.

An Equity Aligned Operating Partner for Hospitality Portfolios

We help partners buy, operate, and scale high-performing hospitality properties through an equity-aligned model.

We Are a Category of ONE

Portfolio > 1 Property

We partner with owners who want to build and scale a vacation rental portfolio over time.

Equity & Fees

We believe in making money when you do. We get paid when you make money.

Results & Promises

The industry is full of broken promises, uncertainty and one-sided deals. We remove that.

Transparency at Every Level

Because the STR industry is broken and someone had to fix it.

We Only Win When You Win

- No hidden fees

- No backend manipulation

- No cleaning arbitrage

- No design markups

- No tech fees

- No upsell skimming

- No revenue theft

- No nickel-and-diming

- Pure alignment

- Pure performance

- Pure transparency

- We treat your asset like a luxury hotel

- We treat you like a partner

- We Make Money When You Do

- ❌ Hidden fees buried in invoices

- ❌ Cleaning fee arbitrage

- ❌ Furniture & design markups (~20%)

- ❌ Setup & onboarding charges

- ❌ Tech stack billed separately

- ❌ Marketing & “software” fees

- ❌ Upsell skimming

- ❌ Backend revenue sharing

- ❌ Opaque reporting

- ❌ Incentives not tied to performance

- ❌ Profit extracted only for manager

- ❌ Treated like a client — not a partner

- ❌ No unique marketing methods

- ❌ Using outdated playbooks

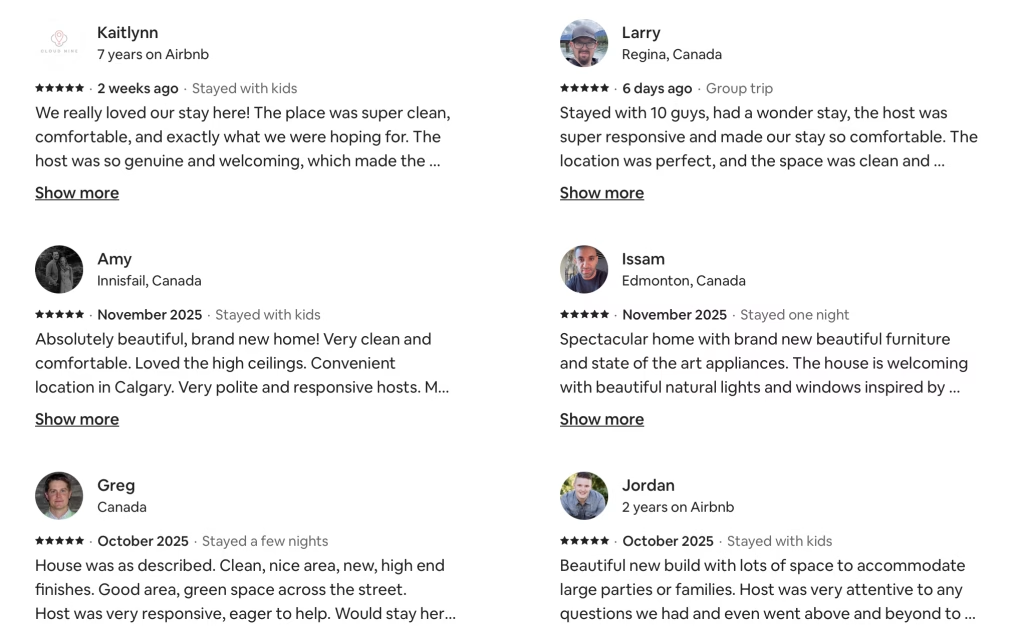

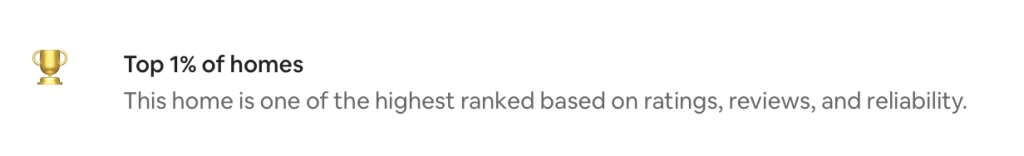

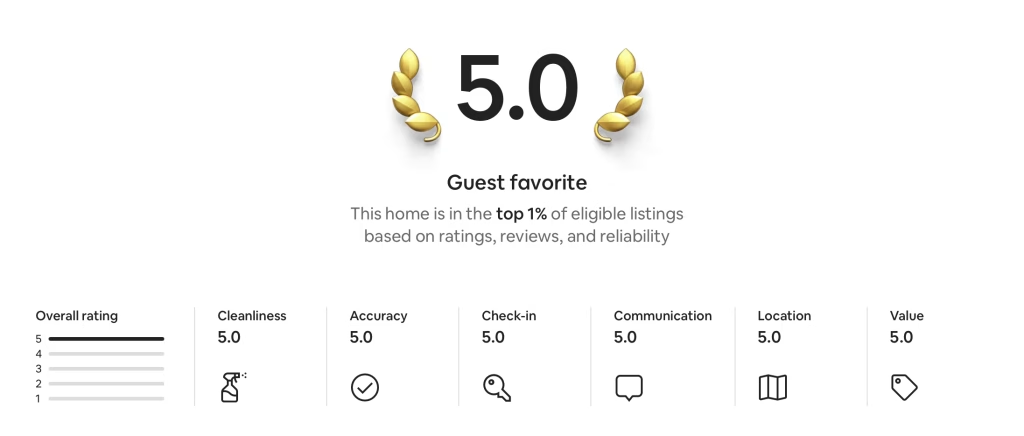

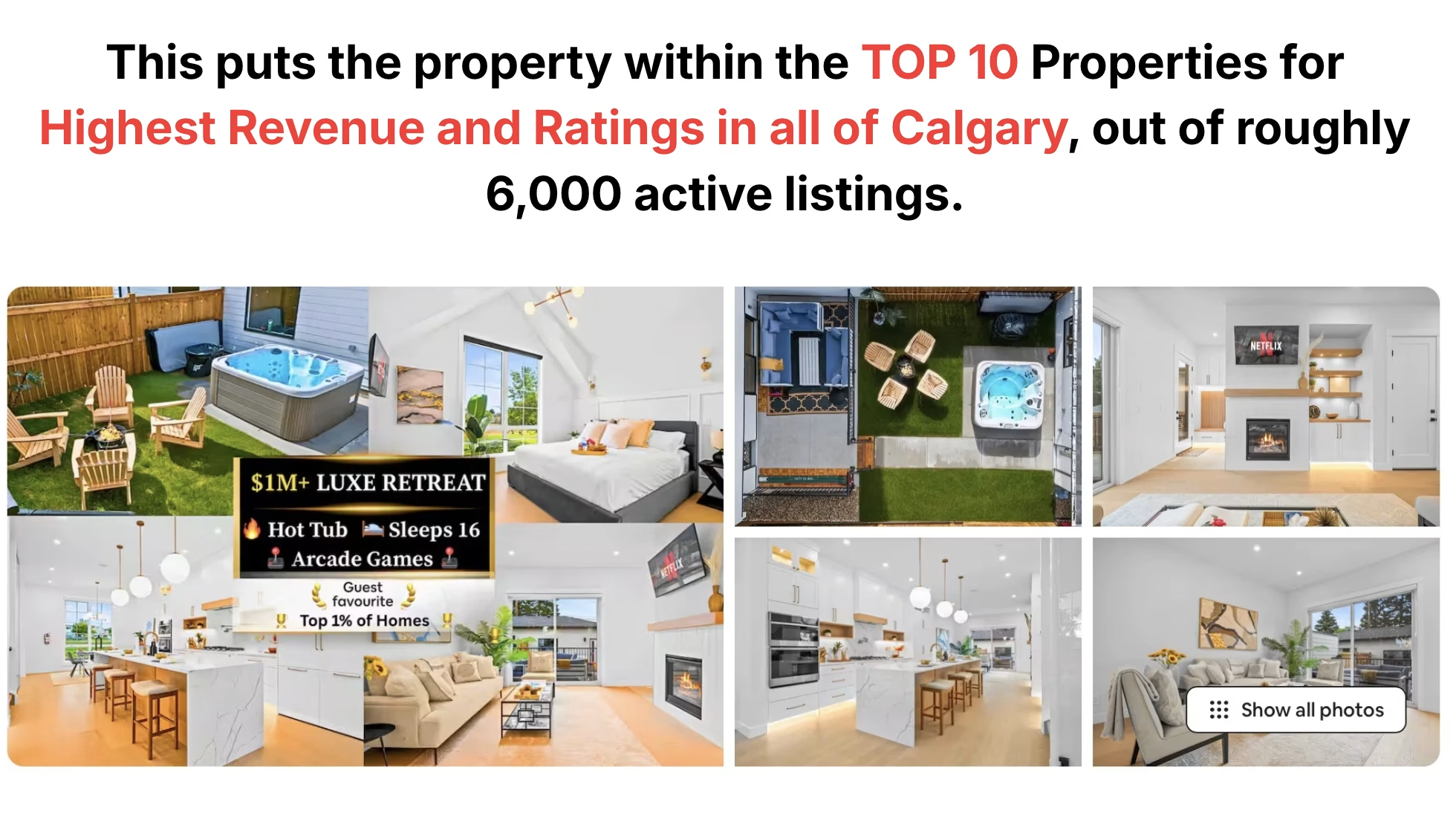

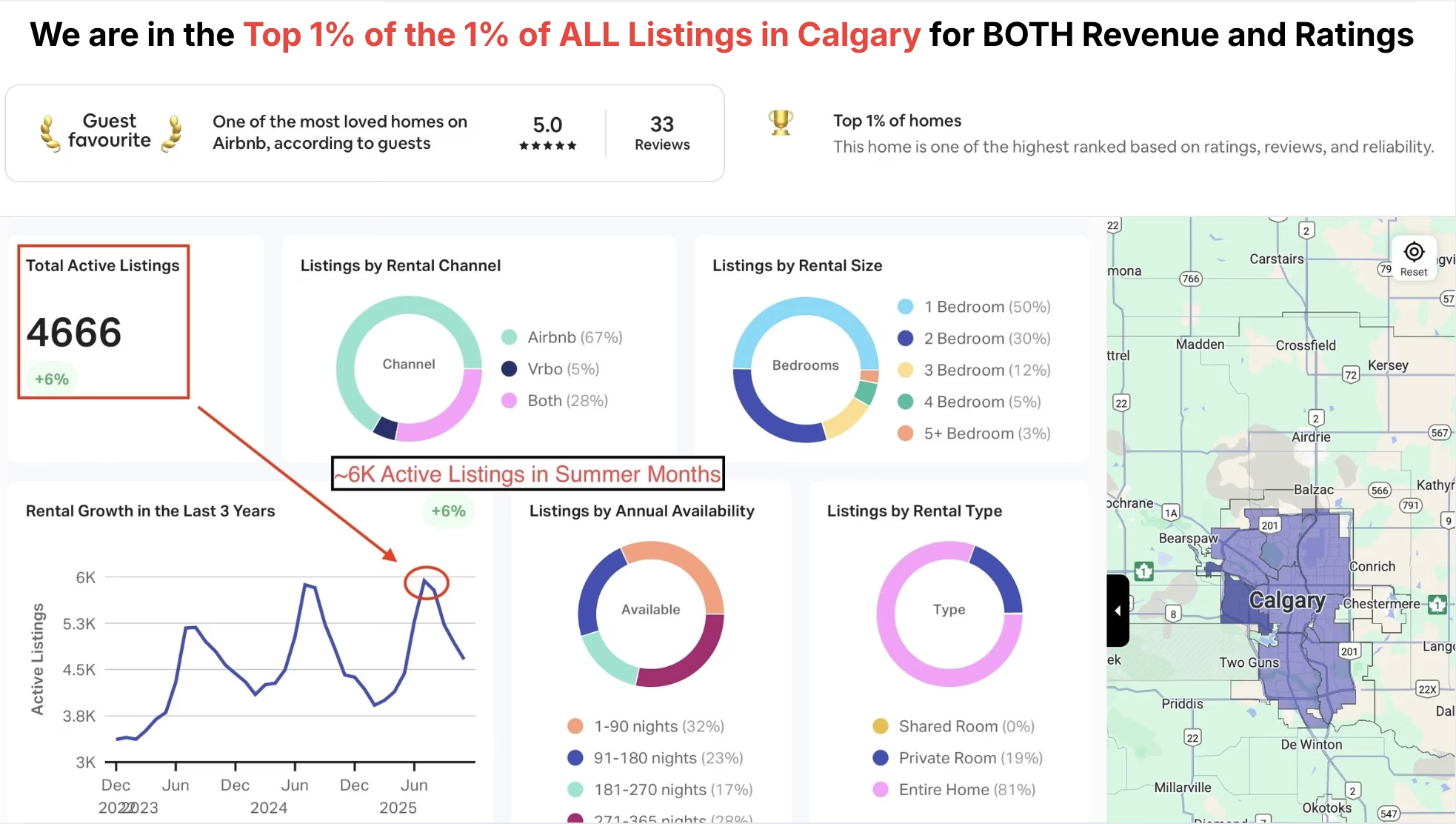

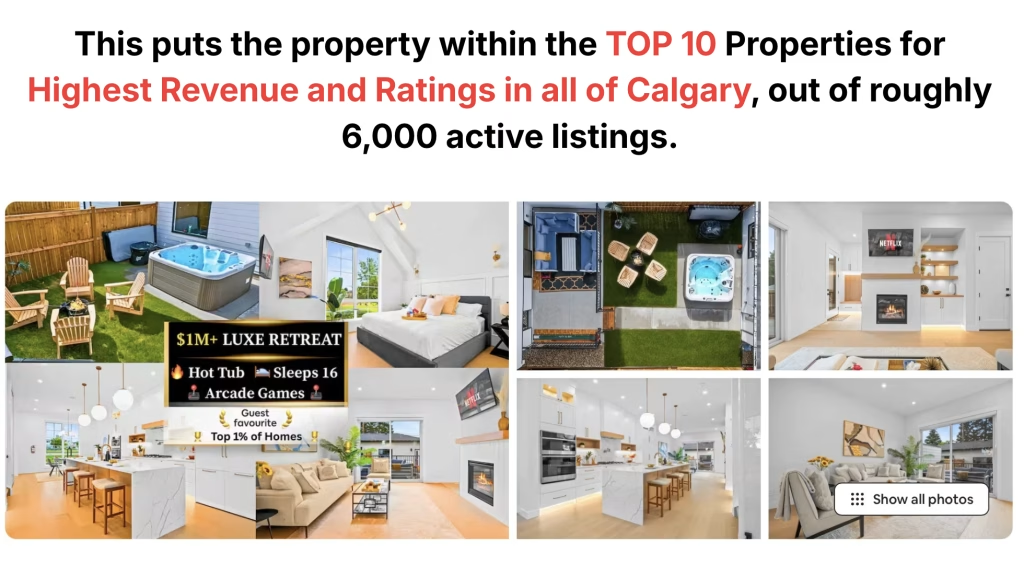

Top 1% Ranked Airbnb in Calgary Out of ~6K Properties

$1.035M Purchase → $1.25M in 6 Months

5.0 ★ across all categories | Purchased for 1.035M Now Worth ~1.25M in ~6 Months

- Property Details

- Purchase Price

- Down Payment

- Furniture + Design + Closing Costs

- Total Acquisition Cost:

- Mortgage (Principal + Interest)

- Property Taxes

- Insurance

- Electricity

- Supplies

- Hot Tub Maintenance

- FF&E Reserve

- Cleaning

- Property Management

- Total Monthly Expenses

- Total Annual Expenses

- Guest Satisfaction

- Market Position

- Guest Reviews

- Airbnb Recognition

- ADR (Average Daily Rate)

- ADR Rate Range

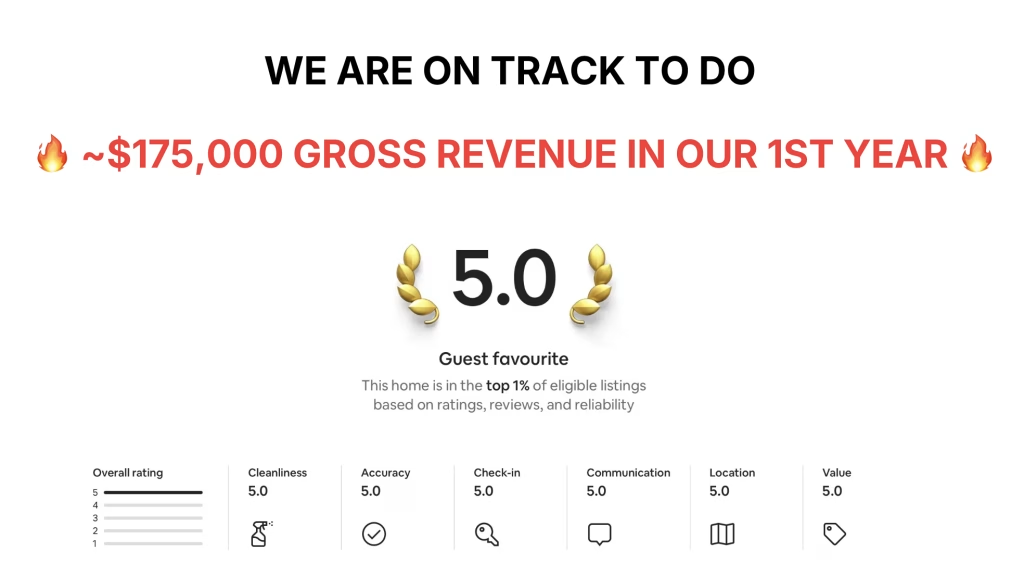

- Gross Revenue (YTD)

- Current Market Value

- Equity Appreciation (6 mo)

- Projected Cash Flow Yearly

- Our Purchase Price

- Current Market Value (Residential Comps)

- Built-In Gain (Immediately Captured)

- Annual Return (Cashflow)

- Annual Return (Equity Paydown)

- Annual Return (Cashflow + Equity)

- Forced Appreciation (Turnkey Premium, 10–15%)

- 24-Month Total (Cashflow + Equity + Built-In)

- 24-Month with Forced Appreciation (Biz Sale)

- 24-Month Multiple (All-In)

- 5-Year Total (Cashflow + Equity + Built-In)

- 5-Year with Forced Appreciation (Biz Sale)

- 5-year Multiple (All-In)

- 5 Bedroom Half Duplex, Calgary AB

- $1.035M

- $207K (20%)

- $75K

- ~$283K

- $4,500

- $500

- $250

- $500

- $250

- $350

- $250

- $2,000

- $2,000

- $10,850

- ~$130,200

- Perfect 5.0★ Airbnb Rating

- Top 10/6000 Calgary Listings

- 40+ verified 5-star reviews

- Top 1% "Guest Favourite

- ~$750 / Night

- ~$750 - $3,000 / Night

- ~$175,000 - $190,000

- $1.25M - $1.3M as a Business

- ~+$250K

- ~30-35K / Yr True Net After ALL Expenses

- $1.035M

- ~$1.10M – $1.15M

- + $65K – $115K

- ~$30K – $40K / yr

- ~$25K – $35K / yr

- ~$55K – $75K / yr

- ~+$70K – $110K / yr (If Sold as a Business)

- ~+$175K – $265K

- ~+$255K - $375K (If Sold as a business)

- ~+1.8x - ~2.3x

- ~$340K – $490K (Excludes Acquisition Costs)

- +$705K – $905K (Excludes Acquisition Costs)

-

~+2.6× – ~3.1× (Excludes Acquisition Costs)

- 5 Bedroom Inner City Luxury New Builds

- ~1.15M (Comparable Property)

- ~200K - ~260K

- ~100K - ~125K

- ~$300K – $325K

- ~$5,000

- $600

- $275

- $500

- $250

- $350

- $250

- $2,000

- $2,000

- $11,225

- ~$134,700

- ~$70 - 82K (after Airbnb fee) - On Average

- 4.7–4.8★

- Nowhere Near Top 10

- Mixed Reviews - No Consistency

- Not Top 1% (Guest Favourite) Gold Badge

- ~$400 / Night

- ~$400 - $1,000 / Night

- ~$1M Can't Sell as a Business

- $0–$30K

- (Net Negative 40K+ a Year After Expenses)

- ~1.15M

- ~1.15M

- ≈ $0

- –$25K to –$40K / yr (NEGATIVE CASHFLOW)

- +$25K to +$35K / yr

- ≈ $0 – ($10K)

- N/A (CASHFLOW NEGATIVE)

- ≈ $0 – ($25K)

- No premium available

- 0.0× – 0.1×

- ~($50K) to $0 (Negative Cashflow)

- No turnkey premium (cannot get +10–15%)

- 0.0× – 0.2×

The Numbers Behind Our Latest

Acquisition

- Acquisition: $1.035M half duplex (20% down ~207K)

- Current Value: Could Sell For ~1.25 - ~1.3M Currently

- 6 Month Equity Appreciation: ~250-300K

- Capital Improvements: $60K+ in design, furniture, and amenities

- Guest Experience: 5.0 ★ across all categories

- Market Positioning: Top 1% of Airbnb listings citywide out of ~6k properties

- Returns: 2.8×–3.3× in 24 months

- Outlook: 4.3×–5.6× projected 5-year multiple

- Engine: Proprietary performance systems push us to the top of the markets.

- Track Record: We have replicated this model in many countries.

How It Works:

Our 6-Step Process

1. Deal Sourcing & Structuring

We identify high-yield STR markets, secure investment-grade properties, and structure deals aligned for long-term equity growth.

2.Underwriting & Pro Formas

Transparent underwriting, risk analysis, and revenue forecasting so you invest with clarity and confidence.

3. Entity & Tax Setup

Specialized attorney's and accountant's help optimize corporate structures in Canada, the U.S., or Mexico to maximize returns and protect your STR portfolio.

4. Design, Setup & Launch

Professional brand-level design, and launch systems engineered to outperform the market from day one.

5. Local Operations Management

Full-service hospitality operations — pricing, guest experience, maintenance, reviews — all handled for you on autopilot.

6. Premium Exit Strategy

We package your property for premium resale valuation through performance history, branding, and future booking transfer.

This model is designed for long-term partners. Fit matters more than volume.

- 20% Minimum Equity in the Deal: We do not structure deals around thin down payments, speculative appreciation, or future capital raises.

-

90 Day Close Target

We prioritize partners who are actively acquiring or converting assets within the next 90 days. This call is to assess fit and answer questions — execution only proceeds when both sides are aligned. If your timeline is longer, we may recommend reconnecting closer to execution. -

Capital & Financing Readiness:

Ability to secure A-Lender financing, with B-Lender approval as an acceptable backup, depending on jurisdiction and asset type. We do not structure deals around speculative or unfinanceable buyers. -

New or Existing Ownership / Control :

• Existing owners with at least 20% equity

• New acquisitions

• Developers retaining assets or building portfolios Ownership alignment is mandatory. -

Investment-Grade Assets:

Properties capable of generating a minimum of ~$100K+ annually, validated through market comps and underwriting. -

Portfolio-First Mentality:

Clear intent to scale to 3+ properties within ~5 years. We help you scale but do not focus on one-offs. -

Institutional Operating Standards:

Owners unwilling to align incentives or relinquish operational control.

- ❌ One-off or lifestyle Airbnb owners

- ❌ Low-equity or over-leveraged deals

- ❌ Rental arbitrage or lease-based strategies

- ❌ Fee-shopping management clients

- ❌ Passive-income seekers expecting guarantees

- ❌ Short-term thinkers not planning to scale

- ❌ Owners who prefer to run the operations themselves

- ❌ Engagements focused on education, exploration, or observation without near-term execution

- ❌ Assets that require aggressive assumptions or hypothetical upside to be viable

- ❌ People seeking free strategy, branding, or underwriting

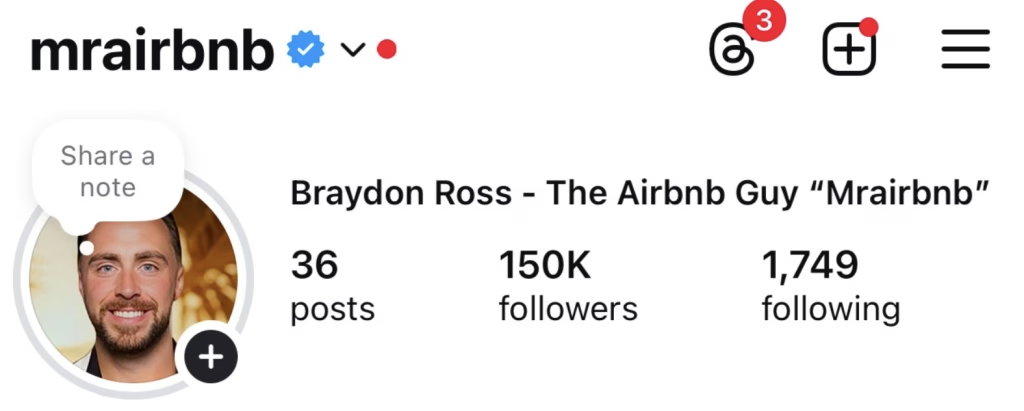

Meet the Visionary Behind $1B+ in STR Listings and $100M+ in Bookings

Braydon Ross “MrAirbnb” is one of the most recognized leaders in the global short-term rental industry.

Through his strategies, partnerships, and thousands of students he taught over the years, he’s listed $1B+ in STR listings and helped drive $100M+ in booking revenue, making him a defining force in the modern vacation-rental movement.

As the founder of one of the largest personal brands in the STR space, Braydon’s work has been featured on major TV networks, top media outlets, and across a loyal community of 150,000+ followers who trust his playbooks for scale.

as seen on

Your Unfair Advantage

The Founder Who Helped Pioneer the Modern STR Industry

- $1B+ listed (hotels, resorts,villas globally)

- $100M+ in booking revenue driven

- Early Pioneer connecting Airbnb ↔ Hotels

- ~10 Years STR experience (since 2017)

- 150,000+ hyper-targeted global followers

- Featured on National TV & Major Media

- Mentored thousands of STR entrepreneurs

- Built the Foundation for Some of the Biggest STR Managers globally

- 1,000s of STR Operators mentored globally

- Recognized as one of the most influential voices in the STR space

- Early Pioneer in arbitrage, STR management, and ownership-driven wealth models

Select Properties We Operate & / Or Co-Own

See the

properties

Lac St.Anne, AB

Top 10% Property

Calgary, AB

150 Reviews

radium, BC

100 Reviews

Calgary, AB

~175K / Yr Revenue

We Are a

Category of One

This Model Does Not Exist Anywhere Else.

Unreplicable in brand.

Unmatched in structure.

Unparalleled in distribution

5 Star Hotel-Experience

~10 years operating STRs, 5-star hotels, and resort-scale assets — not just one-off Airbnbs.

Buyer Demand & Exit Premium

Unreplicable Brand-driven visibility creates premium buyer demand at exit.

Equity-Aligned Performance

Our upside is tied to performance, appreciation, and long-term value.

Brand-Driven Revenue & Trust

150,000+ targeted followers create future buyer demand for turnkey, branded STRs.

The Investor Value Creation Ladder – Home

Ladder A: Luxury STR / Residential Asset

($1.0M–$1.5M Property | Total Average 5-Year View)

- ~$50K–$150K: Saved from management fee reduction based on ~100-150K/yr in revenue

- ~$5K–$15K: Saved from design markup removal

- ~$25K–$100K: Upfront Setup, onboarding & consulting fees avoided

- ~$75K–$150K: Incremental NOI from revenue optimization, pricing, and brand lift (~$15K–$30K annually)

- ~$100K–$250K: Exit premium from stabilized, turnkey STR sale

➡ Total Estimated 5-Year Value Creation:

~$240K – ~$615K+

This ladder shows where aligned incentives actually create investor value. These ~numbers are based on comps + historical performance.

We Market Your Property on All Major Platforms

⚠️ WARNING ⚠️

You Think You’re Paying 15-20%.

You’re Actually Paying 40-50%.

It’s a Trap. Here’s how they hide it:

Charge guest $300 → pay cleaner $150 → pocket $150.

Every stay. All year.

- Quietly baked into the invoice.

- Disguised revenue extraction.

- Early check-ins, late checkouts, concierge… all stolen from owners.

- Charging guests more… and keeping the difference.

-

You never see the true revenue.

Their advertised “20%” is actually ~40–50%.

It’s the Spirit Airlines of STR management:

Cheap at first glance.

Hidden Fees everywhere else.

For Qualified Investors

OUR Two Options

Built for serious real estate investors who want performance, alignment, and scale.

- For investors who want hands-off ownership

- 25K - 100K in Upfront Fees Waived

- Ross Stays operates end-to-end

- Equity earned through execution

- Highly Reduced Management Fees

- Above Market Performance (Average Top 1-10%)

- Ongoing Portfolio Growth and preferred property access

- For owners who prefer to run the day-to-day ops

- You operate day-to-day and manage performance

- Ross Stays handles launch, setup, and positioning

- Once Setup we will hold your hand for 30 Days.

- 50% of setup fee credited toward future equity partnership if you want to switch

- You will be given a playbook for your property and how to run it.

- What You get:

-

Waived upfront Setup fees

(25K for Homes & 50-100K for Hotels) - Access to vetted deals and discounts

- Top Markets Research analysis

- Deal Search and property underwriting

- Acquisition and deal structuring

- Vetted Legal & Accounting providers

- Design, furnishing, and positioning

- Full launch & Day-to-Day operations

- Distribution & Marketing Optimization

- custom portfolio growth strategy

- Exit strategies through sales or refi

- How We earn:

-

Below-market management fees

(~15-20% ALL IN Dependant on Asset) -

Equity Earned Through Execution

(~15-25% Depending on Terms) - Our Most Premium Service From

- Rule:

- If we are not executing, we are not earning equity.

- This is the default and most scalable way we partner.

Our Most Recent Client

Don’t just take our word for it

-

Global Brand Recognition: "Mrairbnb":

Is one of the most recognized names in the STR space with 150,000+ niche followers. One of the largest STR brands in the world. Influential, trusted, global presence -

Brand Lifetime:

~10 years of consistent content, travel, proof, education, speaking, case studies -

Cost to Replicate if Ever:

Would require ~$2M+ in content, travel, ads, networking, media, and a decade of execution -

Global Audience:

National TV, major news outlets, global podcasts. - Influence on Booking Velocity: Brand drives faster reviews, higher occupancy, higher ADR

-

Media Exposure:

Trusted by resorts, developers, luxury villas, hotels across Mexico & North America -

Credibility with Developers, Hoteliers and Investors:

Investors, travelers, hosts, developers, hoteliers, builders, realtors, STR pros -

Unparalleled Track Record:

$1B+ in inventory marketed + helped generate $100M+ in bookings -

Impact on Exit Multiple:

Brand-backed STRs can command ~10–20% premium valuations. -

Larger Buyer Pool:

With one of the biggest brands in the space "Mrairbnb" opens a large buyer pool who pay premiums for turnkey bnb's. -

Proprietary Playbooks:

Operating at the highest level requires custom marketing and operational processes we have only in house.

-

❌ No Global Recognition:

Most founders have no public profile or credibility. -

❌ New Company:

Most brands have maybe 0–3 years in business. Sporadic posts. No authority. New. -

❌ No Competitive Advantage:

No other company Cannot replicate. They rely on ads and discounts. -

❌ No Global Reach:

Local traffic only. Limited to one market. -

❌ Rely on OTA's:

No impact. Reliant on OTAs. -

❌ No Media Exposure:

Little to None. -

❌ Minimal to No Major Partnerships:

No high-level partnerships. -

❌ Small Track Record:

Minimal. Often unverified. -

❌ No Premium Resale:

No brand = comp-based valuation only. -

❌ No Trusted Buyer Pools:

No hyper targeted buyer pool premium resale. -

❌ No Hotel / Resort Marketing Experience:

No hotel or resort level marketing or operational experience. -

❌ Duplicated Playbooks:

Many top managers learned in the industry learned from Braydon to get their start. New Playbooks have been created since then ~6-8 years ago.

-

Immediate Demand & Brand Trust:

Assets launch with built-in credibility, audience, and inbound demand from day one — eliminating years of trial, error, and marketing burn. -

Higher Exit Valuation Potential:

Brand + media + operating performance position assets for premium buyers. These are sold as branded cash-flow vehicles, not commodity STRs. -

Embedded Media & Distribution Moat: Exposure, deal flow, and attention are already owned. Reduced reliance on OTAs, discounts, and paid ads improves margins and resilience.

-

Aligned Incentives (Equity > Fees):

We only win when the asset wins. Equity participation aligns decisions around NOI growth, asset quality, and long-term value — not short-term extraction. -

Institutional-Grade Strategy Boutique Execution:

Hotel-level thinking applied to STR and boutique hospitality. Revenue management, positioning, and asset optimization beyond basic property management. -

Expanded Buyer & Capital Network:

Assets plug into a repeat investor ecosystem, increasing liquidity, refinancing options, and exit velocity at scale. -

Growth Partner:

Strategic alignment across development, operations, and disposition. You’re partnered with an owner-mindset operator — not a vendor.

What is the Ross Stays Equity for Management model?

Ross Stays operates qualifying hospitality assets end-to-end in exchange for reduced management fees plus equity participation.

You keep 100% of the cash flow.

We only win when the asset’s revenue, NOI, and valuation increase.

This is ownership-level alignment, not fee-based management.

Why does Ross Stays take equity at all?

Because equity creates perfect alignment.

Traditional STR managers get paid whether you win or lose.

We intentionally give up guaranteed fees to tie our upside to long-term performance and exit value.

If your property underperforms, we underperform.

That alignment does not exist anywhere else in the STR industry.

How much equity does Ross Stays typically take?

Every deal is structured on a case-by-case basis.

That said, equity participation is typically around ~20% (This is earned on Milestones), depending on:

Deal size

Portfolio scale

Market and asset complexity

Scope of operations

Growth and exit strategy

There is no fixed template. Alignment matters more than percentages.

Do you work with existing properties or only new acquisitions?

Both.

We work with:

Newly acquired assets

Existing, operating properties

However, existing properties must:

Have a minimum of ~20% equity already in the asset, and

Qualify for our Equity for Management program based on performance potential.

We do not take on assets that cannot materially outperform their market.

What types of properties qualify?

We focus exclusively on scalable, premium hospitality assets, including:

Entire hotels

Full STR developments

High-end destination properties

We do not manage:

One-off condos

Arbitrage plays

Low-equity or over-leveraged deals

Non-scalable assets

Owner’s who are NOT looking to scale to more properties

Do you still charge management fees?

Yes — highly reduced, transparent fees.

Enough to support execution.

Not enough to dilute upside.

In fact our fees are so low that not only does it put more cash flow in your pocket since you keep 100% of it, but it increases the NOI and allows us to raise the valuation as a turnkey “Mini Hotel“.

The real incentive is equity growth and asset value, not monthly extraction.

How does this differ from traditional STR management?

Traditional management is designed to maximize the manager’s margin.

Ross Stays is designed to maximize the owner’s wealth.

Traditional models rely on:

❌ 25–35%+ effective fees

❌ Hidden markups

❌ Backend revenue manipulation

- ❌ Owner’s getting paid last + More..

Ross Stays operates with:

✅ Lower fees

✅ No cleaning arbitrage

✅ No upsell skimming

✅ No design or tech markups

✅ Full transparency

We operate like owners because we are owners.

What kind of performance should I expect?

On qualifying assets, Ross Stays consistently targets:

~20–50% revenue outperformance vs local comps (All of our properties currently are Top 1-10% in their respective market)

Faster stabilization

Higher ADR

Stronger occupancy

Higher NOI

Performance compounds over time and directly impacts valuation.

Will my property be worth more if I Sell?

Yes.

Branded, professionally operated STRs typically sell for a ~10–20% premium because they are:

Turnkey

De-risked

Well-reviewed

Professionally operated

Investor-ready

Higher NOI = higher valuation.

That benefits both of us.

Can Ross Stays provide revenue projections for developments?

Yes, we provide detailed revenue projections based on market analysis, occupancy rates, and competitive pricing. This helps developers showcase the earning potential of their properties to potential buyers.

What markets does Ross Stays operate in?

Ross Stays has experience with properties in global markets ranging from and , including:

Our Top 3 Markets Are (Our primary focus):

- Canada

- United States

- México

Our Top Secondary Markets Are:

- South Korea

- Dominican Republic

- + More as we onboard more clients.

Who is this NOT for?

This model is not for:

Owners looking for the cheapest manager

Arbitrage-only strategies

Short-term thinkers

Low-equity or highly leveraged deals

Anyone unwilling to align incentives

What is the long-term objective for both sides?

To help qualified investors build a Multi-Million Dollar Portfolio in 5 Years, with:

Strong cash flow

Refinance opportunities

Premium exit optionality

Access to future boutique hotel and development opportunities

How do we get started?

If the asset qualifies, we structure a custom Equity for Management partnership.

If it doesn’t qualify, we’ll tell you directly.

Qualification Gate (Before Booking a Call)

Can the property realistically generate ~$100K+ per year?

Is there ~20%+ equity in the deal?

Are you looking to build a portfolio, not a one-off?

Are you open to a long-term partnership?

✅ If yes — book a call.

❌ If no — this is not the right fit.

All real estate and investment activities involve risk, including the potential loss of capital. Any forward-looking statements are for informational purposes only and are not promises or guarantees.

Decisions should be made based on independent due diligence and professional advice. Nothing on this website constitutes legal, financial, tax, or investment advice. All relationships are governed exclusively by executed written agreements.

References to “partner” describe a commercial relationship only and do not constitute a legal partnership, joint venture, agency, or fiduciary relationship.

Rosstays is not affiliated with, endorsed by, or sponsored by Airbnb, Meta (Facebook, Instagram), Google, or any other online travel agency (“OTA”), platform, or third-party service referenced on this website. “MrAirbnb” is an independent brand owned and operated by Rosstays and is not affiliated with, endorsed by, or sponsored by Airbnb or any of its affiliates. All trademarks and brand names are the property of their respective owners and are used for descriptive purposes only.